Reyes Capital Management

Our Mission

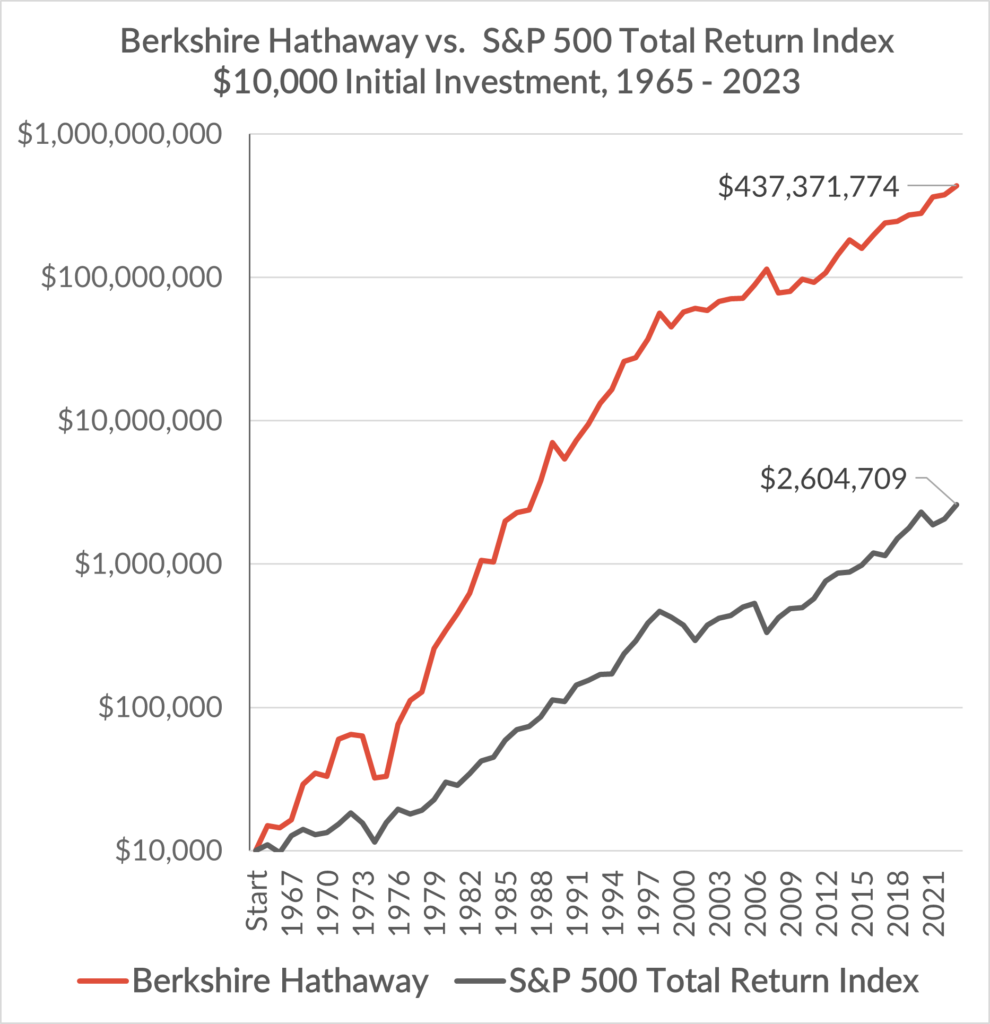

the S&P 500 Total Return index by owning concentrated positions

in a relatively small number of truly exceptional companies.

Investment Philosophy

- Our investment style is inspired by that of Warren Buffett and Charlie Munger, perhaps the world’s most successful investors

- When we make an investment, we think of ourselves as long-term business owners

- We are not perturbed by the ups and downs of the stock market; rather, we maintain a long-term focus solely on the fundamentals of each company in which we invest

Investment Strategy

We invest only in companies offering the highest return potential over the long term, as determined by the following factors:

- Superior management

- High gross and operating margins

- A durable “economic moat” that staves off competition

- Consistently earns above-average returns on capital

- Employs conservative financing strategies

- Generates strong cash flow the company reinvests if it can, or uses for share buybacks if it cannot

We do not invest for short-term gains,

but rather think and act like business owners.

Risk Management

We define risk as the likelihood of permanent loss of capital, not as volatility of investment returns.

We mitigate loss of capital by:

- Focusing on long-term outperformance

- Investing only in “earnings compounders” that have a strong competitive advantage

- Placing a high value on great leadership and financial conservatism

- Always investing across multiple sectors and industries

Leadership

Founder and Fund Manager

Kenneth brings over 30 years of investment expertise and a unique blend of business, accounting, and legal acumen to Reyes Capital Management. He earned his B.S. in Business Administration and Accounting from California State University at San Bernardino and became a CPA, working at prestigious firms like Arthur Andersen, LLP, and Bank of America, where he mastered financial statement analysis and business model evaluation. His early experience in turning around his family’s low-margin restaurant business instilled a focus on high-margin, competitively advantaged investments.

Kenneth also holds a J.D. from Southwestern University School of Law and runs a successful law firm. His hands-on experience in managing his law firm’s retirement funds and a Certificate in Value Investing from Columbia Business School further underscore his comprehensive skill set, making him a well-rounded and insightful investment manager.